Digitalization and the use of technology has been integrated and ingrained in so many of our industries for decades, but nowhere has it been as swiftly and massively adapted as it has in the past two years amid the global health crisis. With public health and safety as an imperative, alongside the continuing necessity of various transactions, the finance and banking industry has had to adapt quickly to—almost to a literal extent—meet the consumers where they are.

What’s unique about the industry’s foray into digitalization is that unlike other industries where millennials and Gen Zs are pioneers, banking’s tech growth has had most users on equal footing. While the younger generations are definitely seen as drivers of digital transformation, it goes hand in hand with the continuous development of technology and the wider spread of the internet, as noted by Erika Dizon-Go, senior vice president Fintech Business Group head of UnionBank.

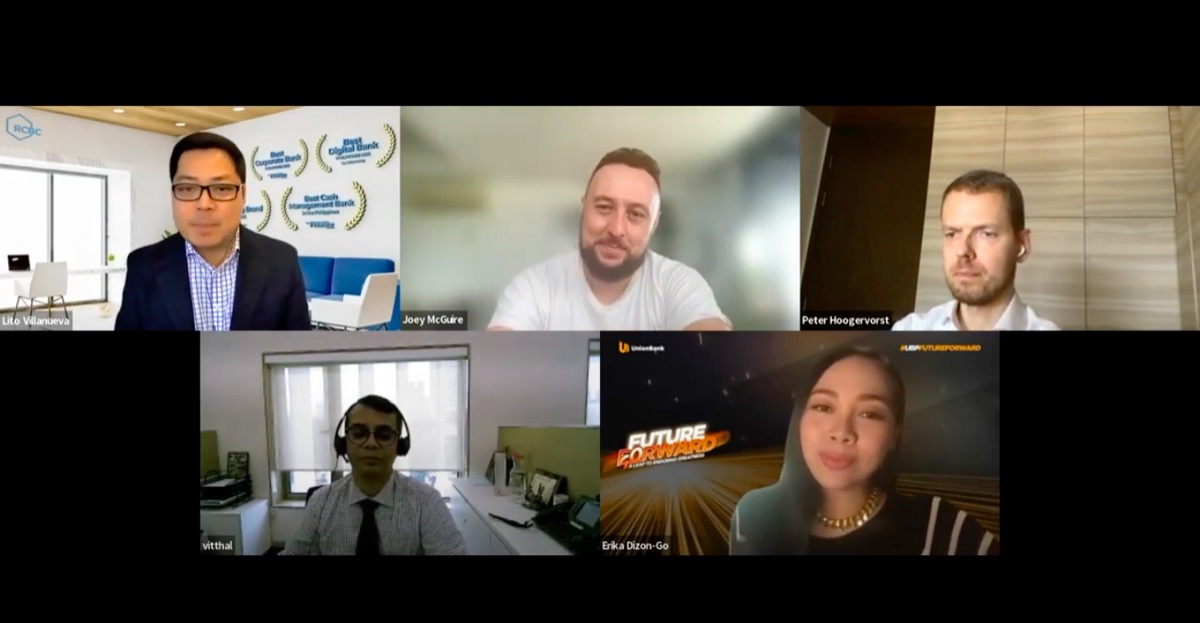

In a discussion organized by Seamless Asia on the region’s changing banking industry landscape leading up to 2025, Dizon-Go shared several insights on the value of Fintech and data in serving and transacting with today’s consumers.

In a discussion organized by Seamless Asia on the region’s changing banking industry landscape leading up to 2025, Dizon-Go shared several insights on the value of Fintech and data in serving and transacting with today’s consumers.

Understanding clients

Technology has been helpful not only in creating ease for customers’ transactions—it has also helped banks immensely in understanding the clients they serve. Being able to track trends, such as changing user behaviors and demographics now are able to inform financial institutions in their strategies.

“We see a rise in wanting to have more choices across the different types of demographics and age groups that we serve. So aside from having different choices, I think a lot of them are also looking towards more personalized services. On our part, the main way that we respond to this is to use different technologies. So we have a data science and AI team that does behavior analysis of what our customers are, what their likes and dislikes are, and what their profiles are, so we can show them better services that are more suited to who each one is.”

— Erika Dizon-Go, senior vice president – Fintech Business Group head of UnionBank.

AI or artificial intelligence, data science, and behavioral science go hand in hand in fine-tuning existing services, as well as coming up with new ones. According to UnionDigital chief data officer David Hardoon, technology, particularly AI, is able to help banks analyze how to optimize operations, be it from creating more efficient bank or cash management, down to managing potential risks seen from data.

This optimization, in the long-run, helps banks meet clients’ needs faster.

Digital trends

Dizon-Go notes that among the major shifts in user preferences is being able to do and avail of more services efficiently. “Aside from doing things when I want as I want it, we also see a shift in behavior in terms of wanting to do things interoperably. So I wanna be able to do everything that I want—be it an insurance requirement, or getting some sort of mortgage, or a need that I have, I want to be able to do it in one place or platform. And so there seems to be a requirement, that we are slowly learning, that we are able to offer different types of horizontal products in one space. I think that’s also why we are starting to see the rise of marketplaces. That’s the shift as well that we’re seeing now,” she says.

Thus, making sure that the bank’s digital platforms, such as its app, doesn’t just provide for quick single transactions. Integrating a variety of functionalities and activities within the app increases its utility for users. “As you increase the user requirements in your app, the number of users and their engagement also increase,” Dizon-Go says.

Also being aware of clients’ other touchpoints is key in adapting to their new needs. UnionBank, for example, saw the opportunity to link e-wallets and e-commerce sites—two highly used digital transactions and platforms with their own banking app. This allowed users of all platforms to do cross-transactions and services.

Inclusivity

Financial inclusivity is a crucial point that institutions must address as we continue moving towards a more technology-forward financial industry. There are still challenges in ensuring that these digital services and platforms can reach majority of the Filipino people, through which infrastructure and policy care of the government will come in.

But each organization must also make their own push, Dizon-Go states. A balance must be struck between being able to see and meet customers where they are on their own financial journeys and growing the financial business.

“There’s a way to intersect customer needs and being customer-centric, while at the same time still being cognizant of your bottomline. But how exactly do we do this? We look at the customer painpoints, and from there we try to build a product but ensuring that there is a business case for it,” Dizon-Go says. “You can’t continue building products for nothing. Although I would say finance and technology at the end of the day is to serve the customer, it’s also still a business. Yes there is a way to do that, you work together with the customer, you identify the painpoints, and then look at the product and see the bottomline with the business case.”