(Second of two parts)

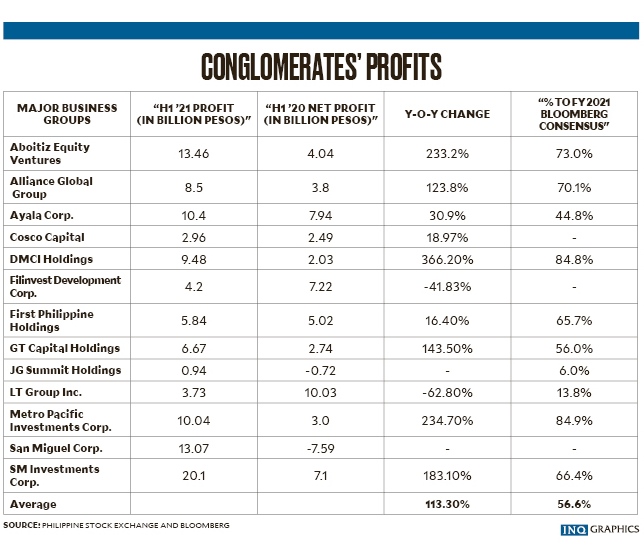

Looking at the country’s top business groups, 11 out of 13 delivered better earnings in the first semester compared to last year, and majority of them attained more than half of market analysts’ consensus forecasts for the full year.

Metro Pacific Investments Corp. and DMCI Holdings, for instance, delivered in the first semester nearly 85 percent of the market’s full-year earnings expectations.

MPIC’s core earnings were driven largely by improved traffic on its toll roads and higher volume of electricity sold, while DMCI benefited from robust coal, property and nickel mining earnings.

On the other hand, JG Summit and LT Group significantly lagged expectations. JG Summit was weighed down by its airline and petrochemical businesses, while hefty loan loss provisioning of its banking business gnawed on LTG’s performance.

On average, the country’s top conglomerates grew first half earnings by 113 percent and met 56.6 percent of full-year earnings expectations.

While most companies either met or exceeded earnings expectations so far this year, there’s still a long way to go for most of them to return to pre-pandemic performance.

Q2 sectoral performance

For the second quarter reporting season, ATR Asset Management head of equity research Dionill Jamill noted that the property sector had significantly missed earnings expectations. He said this was understandable as this was a sector that relied on mobility.

Based on a report by property consulting firm Colliers Philippines, second quarter office vacancy rate in Metro Manila hit 12.7 percent, while average rental rates softened by a further 3.9 percent from the levels in the first quarter. Amid the exodus of once high-flying Philippine offshore gaming operators (POGOs), Colliers expect about 15.6 percent of total office space in Metro Manila to end up vacant by the end of this year.

With foot traffic still largely constrained, shopping malls which used to be the cash cow of many property developers are still a far cry from their pre-pandemic vibrancy.

“Banks generally outperformed despite still a very tepid loan growth environment on lower provisioning for bad loans and a recovery in fees,” Jamill observed.

Last year, banks scrambled to jack up loan loss provisioning at the expense of their profits in anticipation of loan delinquencies during the pandemic.

“Consumer names were split: staples performed well in this period last year and hence came off a high base, while discretionary names benefited from having a low base and operational adjustments they made during the thick of the pandemic,” he said.

For COL Financial, the sectoral outperformers were banking, cement, power and telecom companies, while the underperformers were those from the property and restaurant sectors. Some retailers also lagged estimates because of the renewed lockdowns in the second quarter, said COL vice president for corporate strategy April Lee-Tan.

For JP Morgan, Philippine consumer staples, financials, real estate and conglomerate sectors had exceeded expectations while telecom slightly missed expectations.

As the second quarter reporting season ended in August, the main-share Philippine Stock Exchange index (PSEi) advanced by 9.3 percent, beating Association of Southeast Asian Nations (Asean) and East Asian stock markets, noted First Metro Investment Corp. (FMIC). In September, the PSEi gained another 1.42 percent.

“Foreign investors joined optimistic local investors who witnessed triple-digit second quarter earnings and GDP growth…The rest of the year should continue to see an upward trend, albeit quite volatile since uncertain quarantine restrictions, despite speedier vaccine rollouts, may sideline some investors,” FMIC said in a research note.

Asean trends

Across Asean, JP Morgan strategist Rajiv Batra noted that in the second quarter, Asean companies within JP Morgan’s tracking universe beat topline estimate, as well as bottomline estimates, by 5 percent on aggregate terms.

“If we look at it more specifically, 32 percent of the companies beat consensus estimates in the universe, and 17 percent have missed estimates in terms of sectoral earnings reporting. Financials, material, real estate – these sectors have surprised positively in terms of an earnings reporting,” he said in an interview with Inquirer.

Energy, some of the consumer companies and industrials, and as well as utilities, showed negative surprises, which were likewise reflected in the six-month performance, he said.

“Consumer staples and discretionary sectors are both part of the underperformers. The reason behind is – one, unemployment has been a concern, which has impacted people’s spending pockets. Secondly, salary reduction has impacted household consumption. Finally, because of a lockdown, you cannot buy anything from outside even if there is a pent-up in demand, so there are deflationary sentiments too,” Batra explained.

Asked how far Asean companies were from returning to pre-pandemic levels, Batra said those that would likely perform better than or near pandemic level this year would likely constitute a small proportion.

“And that has shrunk a lot, again, after the second quarter reporting (season) because Asean countries have been in the lockdown during the second quarter, and people are anticipating weaker results in the third quarter.”

“So it is not going to be a surprise if the results are weaker (in the third quarter) – markets are already discounting that,” he said.

For now, he said markets were anticipating that earnings per share (EPS) levels in the region would return to pre-pandemic levels by end-2022 or mid-2023.

“So you can say that the earnings recovery has gotten delayed, not derailed,” he said.

Cascading optimism

Overall, optimism on corporate earnings recovery has improved not just among publicly-listed companies, but smaller enterprises as well.

Based on the 2021 PwC-Management Association of the Philippines CEO survey, 74 percent of chief executive officers (CEOs) said they were optimistic on the revenue growth of their respective companies in the next 12 months, even when 66 percent of them were dissatisfied with the pace of vaccine rollout in the country. Nine out of 10 CEOs projected revenue growth in the next three years.

The PwC-MAP survey – conducted between July and August this year and thus priced in the impact of the COVID-19 Delta variant and the reimposition of mobility restrictions – covered 178 CEOs in the Philippines, 62 percent of whom headed large enterprises while the rest were from micro, small and medium enterprises (MSMEs).

“Surprisingly though, I would have thought that the responses will be different depending on the size of the enterprise or the vibe of the industry. But when we looked at the responses, while some sectors like technology and financial services are maybe a bit more confident than others, there is really no one sector that is overwhelmingly positive or negative about their prospects,” Mary Jade Roxas-Divinagracia, managing partner at PwC Philippines explained in a recent briefing.

As to what’s driving improved optimism among CEOs, Divinagracia noted that a year ago, there was a lot of uncertainty on when the vaccine would be available while there was very little information about COVID-19 and how to fight it.

“But now, we are comforted that we can live with the virus, as long as we get vaccinated, and that we continue the safety protocols…And even when another ECQ (enhanced community quarantine) was actually declared particularly here in the NCR (National Capital Region), this did not dampen the confidence of our business leaders. After 18 months, and four ECQs, I’d like to think that CEOs have had plenty of practice, and some of their initiatives, particularly digitalization initiatives, have led them to thrive during these challenging times.”