Let’s talk about loans. Sure, you’ve heard about the 80-20 savings trick or some daily savings tip that will help you save x amount by year-end. But sometimes, because of things like unexpected expenditures, emergencies, and even large purchases, your budget might fall short despite all your best efforts to save. That’s when loans can come in handy.

Loans aren’t necessarily a bad thing. You just have to be extra wise about the whats, wheres, whens, hows, and whys of taking out one. In fact, most experts will tell you about the benefits of taking out a loan. For starters, a good loan is a quick and easy way to be financially fluid— if you know what you’re getting into.

And if you don’t, here are some tips when taking out a loan.

Do’s:

Select a legitimate banking institution for loans.

Make sure it’s accredited by Bangko Sentral ng Pilipinas (BSP) and the Philippine Deposit Insurance Corporation (PDIC).

You’ll want to transact with reputable banks and financial institutions for your own safety. They are regulated and thus no chances of you being scammed or haggled by predatory lenders. One such bank is Tonik Digital Bank, which is the country’s first neobank, having secured the first official digital bank license from BSP.

Get a loan and pay it in time to maintain good credit standing.

Creditworthiness is something banking institutions look into and factor in when you’re taking out a new loan. Whether you pay in time and have a good credit score determines how much a bank can lend you.

Look for longer-term loans with low interest rates.

It is in your best interest to go for longer-term loans so you can stagger payments. But also don’t forget to look at the fine print for interest rates. Tonik, for one, has a fixed interest rate of 7% for quick loans that are payable up to 24 months.

Choose the “no early repayment fee” option.

Sometimes, when your finances get better and you pay off your loans earlier than your payment terms, banks impose an early repayment fee. Opt for the no early repayment fee option so you can finish the loan without penalty.

Don’t’s:

Get a loan without a stable income.

This is basic: in order to pay what you take out in loans, you have to have a regular source of income. Otherwise, a loan may further strain your finances.

Take out the maximum amount of loan just because you can.

Doing so may further hurt your finances down the line. Consider your capacity to pay and for what reason/s you are taking out a loan.

Make it a habit to take out a loan to pay for other loans.

That’s just bad money management. This will just leave you in an inescapable circle of debt. Only take out loans for necessary expenses and ones that you can pay for in due time.

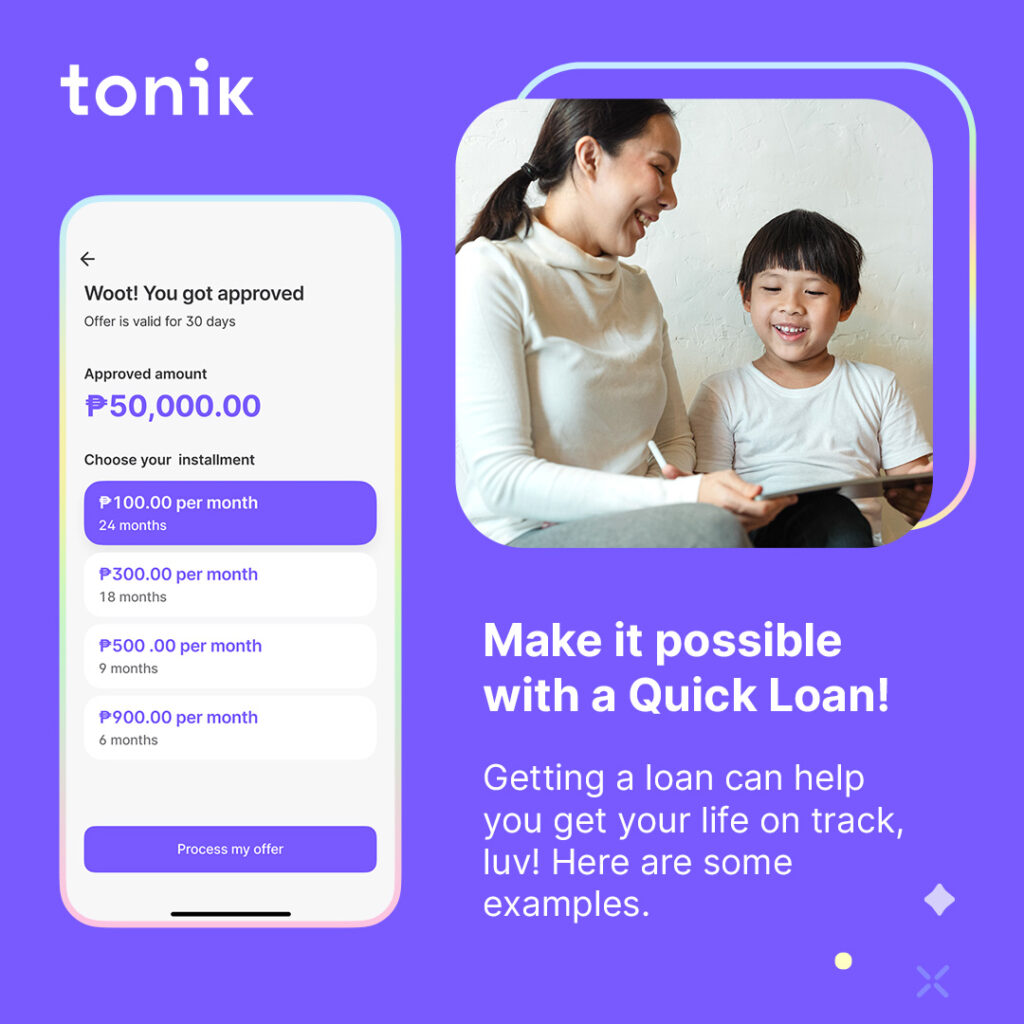

With the rise of digital banking facilities, getting a loan is fast and convenient, too. Tonik gives you access to extra cash of up to P50,000 with low interest rates, doable within a matter of minutes through the Tonik App.

For large purchases, on the other hand, Tonik also offers a Shop Installment loan that lets you get up to P100,000 to finance your appliances, gadgets, and furniture expenditures.

Apply for a Tonik loan today by visiting tonikbank.com/loans.