Having a business is a dream come true for many Filipinos. When one becomes a business owner, they can make a decent income while at the same time be their own boss. It can be a most fulfilling career.

Are you set to start your own business? If you are, you should be ready to complete a lot of requirements and undergo a series of processes that can be overwhelming at times. However, government agencies like the Department of Trade and Industry (DTI), Bureau of Internal Revenue (BIR), and Securities Exchange Commission (SEC) are exerting efforts to make business registration easier and accessible even amid the pandemic.

Business categories

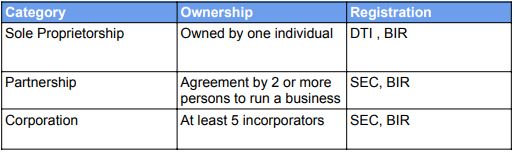

Before registering a business, it is necessary to determine which category a business falls into. Business registration is mainly divided into three main categories: Sole Proprietorship, Partnership, and Corporation. The main difference between these three categories is ownership and which government agency the business will be registered in.

See table below for reference:

DTI Registration (for Sole Proprietorship)

Registering a business name

For Sole Proprietorship, the first step is to register the business name with the DTI. A step-by-step guide can be found on this link and DTI also posted a YouTube video about it. Registering and paying fees can be done online at bnrs.dti.gov.ph. Alternatively, applicants may register in-person by going to the nearest DTI Regional or Provincial office with an accomplished business name registration sole proprietorship application form and a valid government-issued ID.

In instances where the business owner cannot register the business name on their own, a representative may apply on the business owner’s behalf, as long as the representative will also present a valid ID and an authorization letter signed by the business owner.

Who are allowed to register a business name

Any bonafide Filipino who is at least 18 years old may register for a business name. Non-Filipinos can register a business name for as long as they provide necessary documents required and are also authorized to start a business in the Philippines.

Foreigners who want to register a business name and start a business in the Philippines should provide a clear certified copy of the Alien Certificate of Registration and Certificate of Registration for Sole Proprietorship/Certificate of Authority.

Refugees and stateless persons should provide a written recognition from the Refugee and Stateless Person Protection Unit of the Department of Justice (DOJ-RSPPU) and their recognition should not be facing any form of termination from any governing entities of the Philippines.

Registration fee

Registration fee will depend on the business’ territorial scope. Territorial scope means the scope of places in which the business will locate its offices, stores, shops, branches, manufacturing or processing plants, or other business structures or places the business name can be used legally to engage in business. Territorial scope is not to be confused with the limit the business can transact.

The following are the registration fees according to its territorial scope:

-

- Barangay – P200

- City/Municipality – P500

- Regional – P1,000

- National – P2,000

Note that an additional P30 will be charged for Documentary Stamp Tax (DST) and an additional 50 percent of the fee will be charged for filing the business name registration late.

SEC Registration (for Partnership and Corporation)

SEC has made registration for Partnership and Corporation easier with its Company Registration System (CRS). CRS is an online platform for pre-processing of applications for corporations and partnerships for SEC approval. To access CRS, log on to https://crs.sec.gov.ph.

The following are the steps in using CSR:

Create an account

The first step to access CSR is to create an account which can be done by accessing the SEC’s Sign Up form on their website at sec.gov.ph. To create a profile, the business owner must fill out the necessary information about himself and verify their account through email.

Verify company name

After creating an SEC account, the business owner can now log on to https://crs.sec.gov.ph using the credentials that were used in creating the account. The business owner also needs to fill out the company name, company type, company classification, company industry, and other relevant information about the business.

CRS has its own system to validate the company name, and all names are still subject to SEC’s further evaluation despite being validated by the CRS.

The last part of this step is choosing which SEC office where the business owner would like to have their SEC registration processed.

Adding company name

After successfully choosing which SEC office the business owner would process their SEC application, he/she would now input their company’s principal office address on the CSR and mark if their company is in an economic zone.

Adding company details

The system automatically generates the requirements for SEC registration after adding the company’s principal office address. These requirements can be downloaded for signing and sealing.

Lastly, the business owner would also need to input the company’s purpose clause, stock corporation type, term of existence, etc.

SEC also uploaded a video tutorial on this link illustrating the four steps of using CRS.

Requirements

Requirements for SEC registration depends on the further classification of the business. Classifications are: domestic stock corporation, domestic non-stock corporation, domestic partnership, foreign-owned corporation, foreign-owned partnership, and foreign corporation.

A list of requirements can be found on this link.

BIR Registration

All types of businesses whether Sole Proprietorship, Partnership, or Corporation are mandated to register with the BIR.

BIR has provided a list of forms needed for registration that can be found on this link. For Sole Proprietorship the form needed is Form No. 1901, while for Partnership and Corporation the form needed is Form No. 1903. In addition, Form No. 0605 and Form No. 2000 are required for all types of businesses.

Other requirements for BIR registration include DTI or SEC certificates, Mayor’s Permit, contract lease or land title, and business location map.